Create a holistic benefits program tailored to meet your team’s unique healthcare needs.

Tailored insurance solutions for your business, assets, and people with the expertise you deserve and service you can trust.

Transform uncertainty into opportunity with customized risk solutions designed for your unique business challenges.

Create a holistic benefits program tailored to meet your team’s unique healthcare needs.

Tailored insurance solutions for your business, assets, and people with the expertise you deserve and service you can trust.

Transform uncertainty into opportunity with customized risk solutions designed for your unique business challenges.

Global Expertise in Insurance Solutions

Our experts design employee insurance plans tailored to your budget and team needs: backed by global experience for best value.

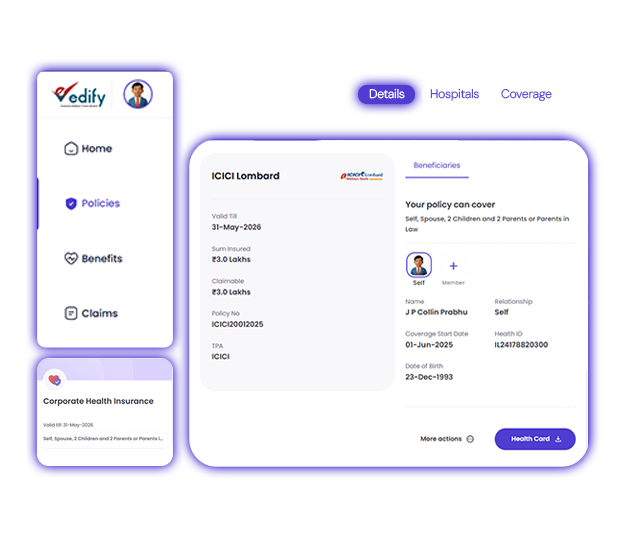

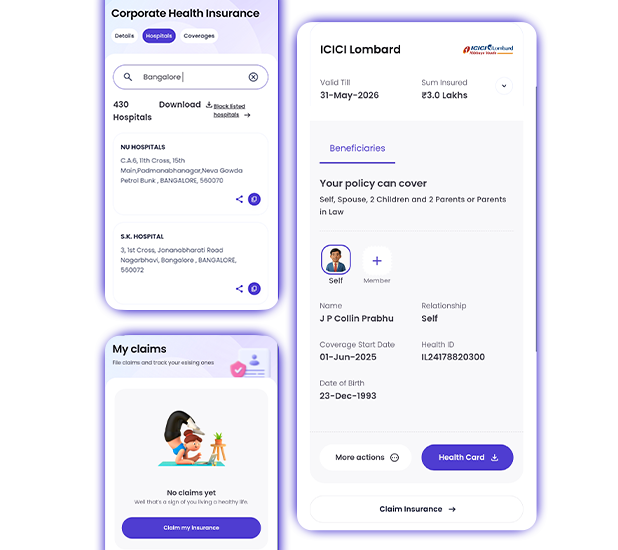

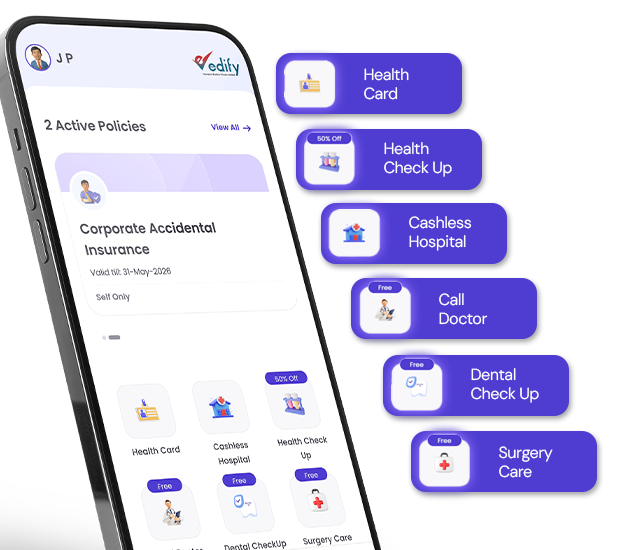

User-Friendly Platform: Insurance at Your Fingertips

Our digital platform simplifies insurance complexities. Employees access policies instantly, while HRs manage programs effortlessly.

Comprehensive Wellness Solutions

Foster employee well-being with our holistic healthcare programs. Enjoy quick health consultations and wellness sessions for your team.

Our intuitive digital platform brings clarity and control to your insurance program

View all your coverage in one place with easy access to policy details, limits, and renewal dates.

Submit, track, and resolve claims digitally from start to finish.

Access all your certificates, policy documents, and endorsements instantly from any device.

Expert Solutions Designed for Your Specific Protection Needs

Comprehensive healthcare and protection plans that attract talent, boost morale, and demonstrate your commitment to employee wellbeing.

Safeguard your business assets and shipments with coverage that ensures continuity and peace of mind through any disruption.

Protect your business from legal and financial exposure with tailored liability coverage that addresses your specific industry risks.

Customized solutions for unique or complex risks that standard policies don't adequately address, from cyber threats to professional services.

Protect what matters most to you and your family with comprehensive coverage for health, life, motor, travel, and valuable possessions.

With “Edify” you reap the benefits of having a high expertise in-house insurance department, but without the overhead. Our clients seek our advice to negotiate insurance requirements with principals and devise strategies to quantify, mitigate and transfer risk and unlock business potential. A contained risk environment not only spurs productivity but opens new markets and business opportunities.

We do not leave anything to chance. We proactively remain abreast of each insurer’s unique underwriting criteria and deliver our submission to the most relevant insurers. This approach helps us get favourable results from the insurers in a timely manner. The reputation and respect we have earned with the insurers over the years help us simply produce better results: the most comprehensive coverage for the lowest premiums.

We collectively have unrivalled market knowledge of insurance products and best practices for companies across a broad range of industries. We openly share this information and brainstorm with our clients, creating value that goes beyond insuring risk. We help you to get the best terms and service from your insurer by evaluating the ‘terms’ and ‘service’ you are enjoying today vis-a-vis the ‘best’ available in today’s competitive market.

Precision crafting of insurance covers with the best terms allows us to create fool proof covers for our clients with best available options in the market. Our domain knowledge and expertise helps us to unravel surveys and assist in speedy and fair settlement of claims. Our ever-responsive Customer Services assists clients in negotiating the best results in claim situations.

We are committed to delivering top notch value added services to start-ups and mid-market companies with the highly personalized attention you deserve in nurturing talent and having expert advice on your risks. Our philosophy of investing our time and effort with the best services outlines our belief in growing with our clients. We are committed to building relationships based on high level of trust and transparency.

Our rich experience and knowledge allows us to structure specialized insurance programs – customized insurance packages and deliver better than market customisations for our clients. Our clients benefit from our international insight from best global practices and advise on insuring risk beyond the Indian boundaries. We carry deep insight into Insurance markets and regulations in most countries India does business with.

Insurance Strategies Crafted for Your Industry's Distinct Needs

Specialized protection for intellectual property, data risks, global operations, and high-value talent in fast-evolving environments.

Comprehensive coverage for equipment, facilities, supply chains, and workforce safety in both traditional and advanced manufacturing.

Tailored solutions addressing unique liability concerns, regulatory requirements, and specialized facility protection needs.

Project-specific and ongoing coverage for development risks, contractor liability, equipment, and specialized construction operations.

Protection against liability, errors & omissions, and business interruption for consulting, legal, accounting, and advisory firms.

Trusted by Businesses Across India

Edify has been an exceptional partner in our wellness journey. From organizing well-structured on-site wellness camps to delivering engaging virtual sessions, their execution is consistently smooth and thoughtful. What sets them apart is their flexibility and creativity—they go beyond traditional wellness by curating uplifting, feel-good events that truly energize our workplace. With Edify by our side, employee engagement is one area I never have to worry about—they manage it seamlessly and with genuine care.

Having used the services of insurance professionals of EDIFY for more than 7 years, for the company and personal requirements, we have found them to be very professional, upright and straightforward in all their dealings. The team is capable of providing proper and correct professional advice for our required covers. We want to place on record their commitment and ownership in supporting the needs of the organization. Apart from being competitive in terms of price and coverage, they are very responsive and we would recommend them to anybody who are in need of insurance requirements.

Working with Edify Insurance Brokerage has been an exceptional experience for our company. Their team's deep insight and expertise have significantly enhanced our insurance programs. They've transformed what was once a complex and uncertain setup into a robust, well-structured framework, providing us with complete peace of mind. Edify took the time to truly understand our unique needs, identifying and addressing gaps we hadn't even recognized. The solutions they developed are incredibly comprehensive, and we are absolutely confident that we are in the best possible hands with them.

Edify has made managing employee benefits effortless. Their intuitive portal dashboards provide complete visibility into claims, member information, and usage trends, enabling informed decision-making with ease. The WhatsApp integration is a standout feature, allowing employees to access e-cards, network hospitals, and claim tracking seamlessly. What truly sets Edify apart are their added digital healthcare services, including free doctor and dental consultations, discounted diagnostics, and preventive health check-ups, which have garnered widespread appreciation. Overall, Edify has significantly enhanced our benefits experience, making it efficient, personalized, and impactful.

Edify has been a reliable partner in managing our Group Medical Policy. Their unwavering responsiveness, even beyond regular working hours, has been a true support system for our employees. What sets them apart is the patience and empathy their team shows in every interaction. They go beyond service, Providing genuine care. For me it is reassuring to know our employees are in such capable and compassionate hands. I can step away from the day-to-day benefit administration with full confidence, knowing their team is consistently delivering the highest standard of support.

Our team is ready to analyze your risks, design your coverage, and provide ongoing support that goes beyond standard insurance services. Experience the difference that strategic risk management can make for your business.